This post is part of a social shopper marketing insight campaign with Pollinate Media Group® and Greenlight, but all my opinions are my own. #pmedia #GreenPMG http://my-disclosur.es/OBsstV

As kids get older it’s important that we are Teaching Kids How To Manage Money. Here’s how I’m using Greenlight, the smart debit card for kids, with my teenagers!

Whether I’m ready or now (mostly I’m not) the twins are about to turn 16 years old. That means driving, first jobs, and more adult responsibilities are right around the corner. As we’re talking about test prep and potential college choices, I’ve also been thinking about all the other things kids need to know before they are really out on their own.

Have I given them basic cooking skills? Sort of. Do they know how to do their own laundry? Yes. Have I taught them how to manage money? Probably not as well as a I should have. Youngest Twin is anxious to get a job after he turns 16. He’s a planner and has things he wants to save for. I knew that Greenlight, the smart debit card for kids, would be a great option for him.

With his new card in hand I wanted to make sure we went over creating a budget. I mentioned that Youngest Twin is a planner, so he knows that part of his income will be put towards saving. But he’s also a teenager and so a portion of his income is also designated for activities of his choosing. That will also need to include planning for gas and other outing requirements.

The Greenlight card is ideal for kids ages 8 to 18. If you’re using the card instead of cash for you child’s allowance the app offers a convenient automated allowance feature. This lets you set it up once and then forget about it, and your kids always receive their allowance on time.

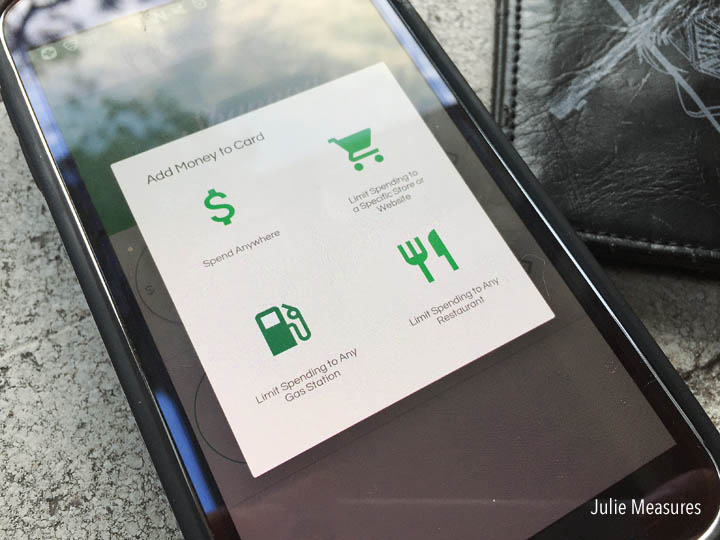

It’s also a great way to give your kids independence to spend their own money while you, as the parent, retain control over where their money is spent and how much they have to spend in certain stores or types of retailers. For my sons card I can allot some money for him to spend anywhere, and other money that can only be spent at a gas station (to make sure he can always get gas), or to a restaurant (to make sure he can always get lunch). You also have the option to freeze all spending at any time.

Whether your child makes a purchase, requests money, or sends you a message, you’ll receive an instant notification of all activity so you’re always in the know. Greenlight costs just $4.99/month per family, which includes cards for up to 5 children. It also offers zero-fee loading for parents transferring money into their Greenlight account.

Take advantage of the special 30-day trial to see if it is a good fit for your family and get a $20 deposit bonus when you sign up after the trial!

Greenlight is far safer than cash beyond just having a unique PIN. Even if the card is stolen, thieves will be hard pressed to figure out which stores the card will work at without also having access to the app! The Greenlight app is available for iOS and Android.

Sign up for Greenlight before 10/30 and they’ll deposit a $20 bonus into your account after the 30-day free trial ends. *deposit bonus made approximately two weeks after free trial ends

Leave a Reply

You must be logged in to post a comment.